WINGX Global Market Tracker:

European bizav market sags as North American demand plateaus

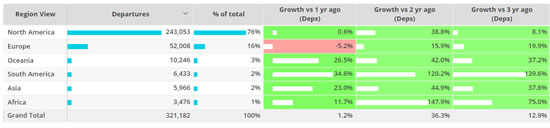

According to WINGX`s weekly Global Market Tracker published today, there have been 321,182 business jet and prop flights operated in the first 3 weeks of August, up 1.2% on comparable August 2021, up 13% compared to August 2019.

Three quarters of flights have been operated in North America, these up 0.6% on last year, gaining 8% on August 2019.

European demand for business aviation is sagging, down 5% on August 2021, though still 20% up on August 2019.

Globally, from January through 1st August, business aviation flights are 17% above last year, 15% above pre-pandemic. August 2022 scheduled airline activity is 21% below pre-pandemic August 2019, although the top 5 busiest commercial airlines (Southwest Airlines, United Express, American Airlines, Ryanair, Delta Airlines) have flown only 7% less than in August 2019.

Global business aviation fixed wing activity, 1st August – 21st August 2022.

(click for larger format)

North America

Business jet activity in North America is trending up by 1.6% so far this month compared to August 2021, up 15% on August 2019. Week 33, ending 21st August, was down 0.2% compared to Week 32, and up 1.4% compared to Week 33 last year.

The weakest part of the market is Charter and Fractional, with Part 135 and 91K flights slumping 8% in Week 33 Year-on-Year and down 5% over the last 4 weeks.

Business jet activity in Texas fell 8% in Week 33/32, and was down 12% compared to Week 33 in 2019. Branded Charter operators are seeing even larger falls in the most recent week, with 17% drop in the US, and 23% decline in Canada, versus Week 33 in 2019. So far this month, branded charter flight hours are down 16% vs last year, but still 26% up on August 2019.

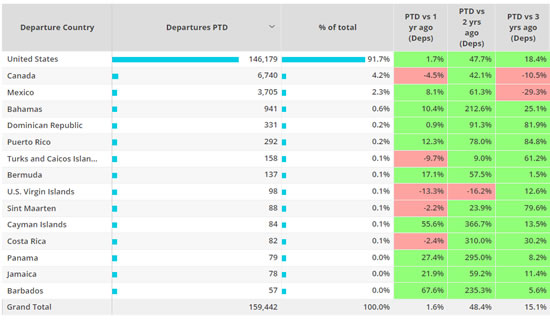

Compared to last year, this August is seeing less demand in Canada, as well as key leisure resorts in Turks and Caicos, US Virgin Islands, Sint Maarten and Costa Rica. Apart from Canada and Mexico, the region has stronger demand than in 2019, notably for Dominican Republic, Sint Maarten and Puerto Rico, all with at least 80% more flights than in pre-pandemic August 2019.

For this August compared to August 2021, California, Colorado, New York and New Jersey are all down, with New Jersey behind 2019 trend. But there is still comfortable growth in Florida for the month so far, 5% more flights than August last year, and 47% increase on August 2019.

Busiest business jet markets, North America, 1st – 21st August 2022 vs previous years.

(click for larger format)

Europe

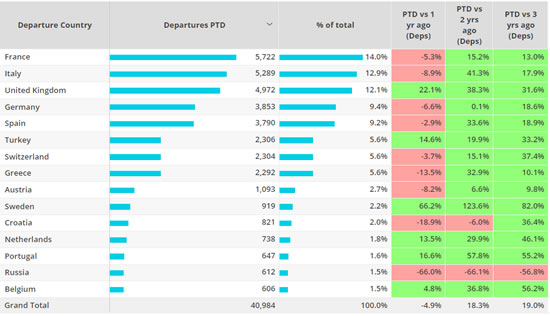

As Europe’s seasonal peak in bizjet demand passes, the market is seeing much weaker year on year activity, with the month-to-date down 5% compared to last year. Such is the rebound over the last 12 months that the region is still well ahead of 2019, with 41,000 bizjet flights this month up 19% on August 2019.

The big declines, year on year, are apparent in France, Italy, Germany, Greece, Austria. Business jet activity in Russia has sunk back 66% from August last year and is less than half of what it was pre-pandemic. The year-to-date view, January through August, still shows big gains on 2019, with comparable growth of 18%. Business jet activity in France is up 13% this year compared to pre-pandemic, departures from the UK are up by 21%.

Top Europe Business jet markets, 1st – 21st August 2022 vs previous years.

(click for larger format)

Managing Director Richard Koe comments: “The European market is now clearly coming off peaks in activity in August 2021 and August 2020, but these were unseasonable peaks specifically related to the pandemic.

"Overall, business jet travel in Europe is still 20% up on August 2019. The US market is softening, with weekly slowdown in the charter market, although owners and corporate flight departments are still flying more than ever.”

WINGX is a data research and consulting company based in Hamburg, Germany. WINGX analysis provides actionable market intelligence for the business aviation industry. Services include: Market Intelligence Briefings, Customised Research, Strategic Consulting, Market Surveys. WINGX customers range from aircraft operators, OEMs, airlines, maintenance providers, airports, fixed base operators, fuel providers, regulators, legal advisors, leasing companies, banks, investors and private jet users.

“The European market is now clearly coming off peaks in activity in August 2021 and August 2020, but these were unseasonable peaks specifically related to the pandemic.

"Overall, business jet travel in Europe is still 20% up on August 2019. The US market is softening, with weekly slowdown in the charter market, although owners and corporate flight departments are still flying more than ever.”

Richard Koe, MD, WINGX.

WINGX GmbH

Lilienstraße 11

20095 Hamburg

Germany.

+49 40 23 96 85 05

BlueSky Business Aviation News | 25th August 2022 | Issue #666

Share this article

| © BlueSky Business Aviation News Ltd 2008-2022 |