WINGX Global Market Tracker:

No jets for Davos but more than ever for the ski slopes

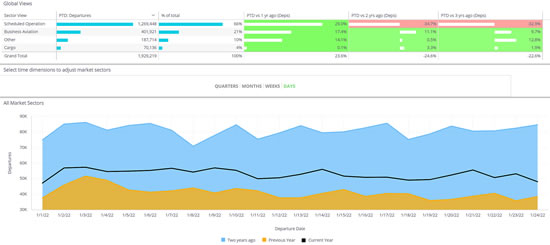

Three weeks into January 2022, global business aviation traffic has surpassed last January by 17%, and is tracking 10% up versus January 2019, according to WINGX`s weekly Global Market Tracker, published today.

Scheduled passenger airlines have operated 29% more flights than in January 2021, but 30% fewer than in January 2020. Since business aviation demand rebounded in mid-2021, flights have exceeded the same pre-pandemic period by 12%. This month´s numbers were boosted by the New Year holiday, flights up 20% on the New Year week in 2019. Things have cooled down since the world went back to work, but even the latest week was the busiest ever for mid-January, up 31% on last year, up 9% on 2020 and 5% higher than in 2019.

Global fixed-wing flight activity in January 2022 compared to 2021 and 2020.

(click for larger format)

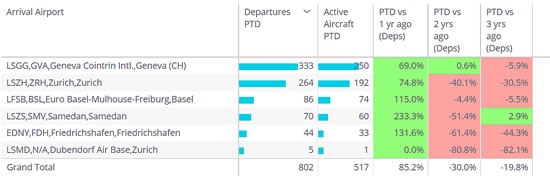

Normally, for business aviation, January means Davos, with a handful of airports - Zurich, Samedan, Dubendorf, Friedrichshafen, Basel, and Geneva - hosting global leaders and their plenipotentiaries at the World Economic Forum.

For a single spike in business aviation traffic, the WEF event can rival the Monaco Grand Prix weekend. This year the WEF has been postponed to early summer, leaving a big hole in local activity. Zurich in particular has seen at least 40% fewer business jet arrivals in the last week than in January 2019 or 2020. The event was cancelled in 2021, and in contrast to locked-down travel 12 months ago, all the same airports are much busier.

Business aviation activity at top WEF airports in 2022 compared to 2019, 2020, 2021.

(click for larger format)

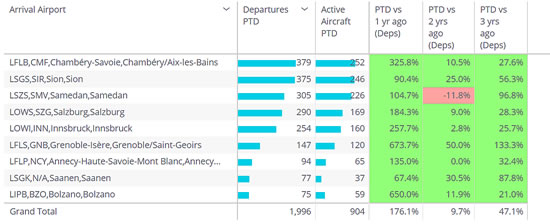

Whilst the absence of the WEF means a lot less corporate and government use of private jets, the leisure end of the market is still booming. This is particularly obvious around the ski resorts. For nine of the most popular airports for the top Alpine ski resorts, business aviation traffic is 47% higher than in January 2019. Grenoble has well over double the private flights it had 3 years ago. Samedan has double the arrivals of January 2019, even if slightly fewer flights than in January 2020.

London is the most popular departure city, with flights to these nine airports up by 55% compared to 2019. Moscow is the third most popular departure city, ski arrivals up 17%.

The Citation XLS is the most popular business jet for skiers this year, with 222 arrivals into these airports, up by 26% versus January 2019.

Business aviation activity at top European ski resort airports in 2022 vs 2019, 2020, 2021.

(click for larger format)

North America

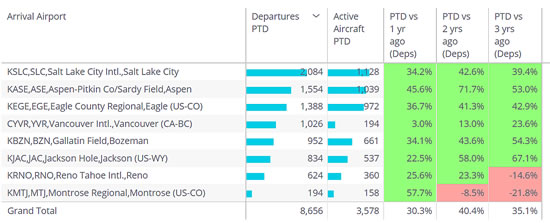

The leisure demand for the ski trips by private jet is equally evident in North America. Across eight airports which host some of the most popular resorts, arrivals are up by 35% compared to January 2019. Salt Lake City and Aspen are getting the lion´s share, with close to 50% more traffic than before the pandemic.

Even Vancouver, despite the prolonged lockdown in Canada, is seeing much more business aviation this winter than in 2019.

Only Reno and Montrose are seeing fewer flights than 3 years ago. Airports in Los Angeles are generating the most ski demand, departures up 70% versus 2019. Other key metro hubs are Phoenix, New York, Las Vegas and Dallas. Compared to January 2019, the business aviation aircraft types with the most growth are the King Air 350 and the Citation Latitude.

Business aviation activity at top US ski resort airports in 2022 vs 2019, 2020, 2021.

(click for larger format)

Rest of the World

Outside North America and Europe, business aviation traffic is up by 10% this year, almost 50% up on three years ago.

Al Maktoum is the busiest airport, with activity up almost 200% on January 2019. Most of the growth has come from domestic flights, notably in Australia, Brazil, Colombia, China, Nigeria. Apart from OMDW, the busiest airports so far in January are Sao Paulo- Congonhas, Riyadh-King Khaled, Male, Ben Gurion, Murtala Muhammed.

For arrivals into Europe, the busiest airports in January are Vnukovo, Ataturk, Le Bourget. Coming into the US, the busiest arrival points are in Florida, although not yet back to where they were in 2019. Houston business jet arrivals from outside the US are up 60%.

Managing Director Richard Koe comments “Before the pandemic, January´s business jet activity was characterised by the influx of business aircraft to airports near Davos, with this year´s absence marked by a 30% drop in activity at Zurich.

"The missing government and corporate traffic has been more than made up by leisure demand for ski trips this month, these at record levels, as much in the US as in Europe.”

WINGX is a data research and consulting company based in Hamburg, Germany. WINGX analysis provides actionable market intelligence for the business aviation industry. Services include: Market Intelligence Briefings, Customised Research, Strategic Consulting, Market Surveys. WINGX customers range from aircraft operators, OEMs, airlines, maintenance providers, airports, fixed base operators, fuel providers, regulators, legal advisors, leasing companies, banks, investors and private jet users.

“Before the pandemic, January´s business jet activity was characterised by the influx of business aircraft to airports near Davos, with this year´s absence marked by a 30% drop in activity at Zurich.

"The missing government and corporate traffic has been more than made up by leisure demand for ski trips this month, these at record levels, as much in the US as in Europe.”

Richard Koe, MD, WINGX.

WINGX GmbH

Kiebitzhof 6 | Building G

22089 Hamburg

Germany.

+49 40 32 84 69 78 phone | +49 40 32 84 69 79 fax

BlueSky Business Aviation News | 27th January 2022 | Issue #638

Share this article

| © BlueSky Business Aviation News Ltd 2008-2022 |