There were 79,280 business

aviation departures in September according to WINGX`s latest monthly

Business Aviation Monitor. The figure represents a 2.9% increase YOY, taking

the YTD trend to 3.6%. Activity in September 2017 was still 4.4% behind the

pre-crisis peak in September 2008.

All the leading markets were

up, with modest gains in Germany, UK and Italy. France achieved 3% growth

and Switzerland 8%. Germany, Spain and UK are seeing a combined increase of

around 1,000 flights per month so far this year.

Smaller markets with strong

growth included Greece, flights up 14%, and Turkey, whose flight activity

gained 10% YOY. There was some decline in Norway, and flights were down 6%

from Ireland, down 8% from Croatia.

The Southern Med region

continued to be the hub for growth in business aviation this month, flights

up 7% in September. Eastern Europe saw 2% gains, but is still trending up 5%

YTD. Overall, business aviation flights within Europe were up 3%.

Flights from Europe to other

global regions were muted, with flat activity to Middle East and declines to

North America and CIS region. Arrivals into Europe from Asia-Pac were up

21%, and arrivals from China increased almost 40% YOY.

The main growth continues to

come from AOC activity, with 39,288 AOC flights this month, up 7.5% YOY. AOC

activity has grown in every month since October 2016. Business jet AOC

flights were up 9% this month. Private flights declined YOY.

|

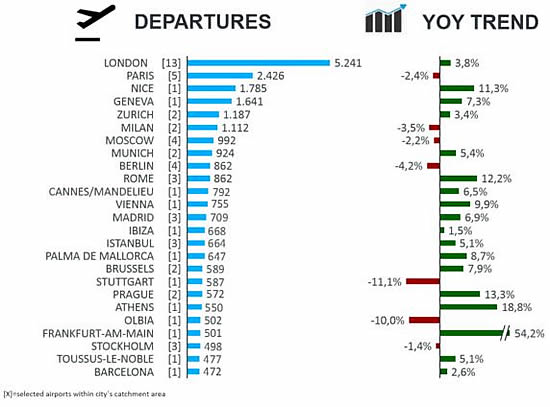

Activity trend by City |

|

|

Flights

were up from London, and saw strong growth in Nice and Geneva. |

Aircraft

The

largest YOY growth in flights this month came from the Textron fleet,

sectors up by 5%. Textron Light jet sectors were up 10% YOY, and Midsize

flights were up 80%. Embraer aircraft saw most increase in activity, up 29%

overall, +37% in AOC activity.

The busiest aircraft types

this month were Citation Excel/XLS, activity, up by 3%, and King Air 200,

flights decreasing by 6% YOY. Phenom 300 AOC activity is seeing growth of

almost 60%. Citation Bravo AOC activity was up more than 10% YOY.

Airports

A few of the busiest airports

saw some decline this month, including Le Bourget, Luton and Linate. Nice

had strong growth, flights up by 11%, and AOC sectors gaining 16%. Biggin

Hill departures were up by 15%, AOC flights up by 27%.

Richard Koe,

Managing Director of WINGX Advance, comments: “The summer season for

business aviation slowed slightly in September but still saw strong demand

in Charter activity, especially in the Small Jet segments. By contrast,

Owner flight activity continues to stagnate. Newer aircraft such as the

Citation Latitude are seeing very strong growth, although older types

including the Citation Bravo and Legacy 600 are also much busier in the

Charter market. It will be interesting to see if the charter market can

sustain its growth trend going into the 4th Quarter.”

Download the latest Business Aviation Monitor

WINGX

Advance is a data research and consulting

company based in Hamburg, Germany. WINGX

analysis provides actionable market intelligence

for the business aviation industry. WINGX

services include: Market Intelligence Briefings,

Customised Research, Strategic Consulting,

Market Surveys. WINGX customers range from

aircraft operators, OEMs, airlines, maintenance

providers, airports, fixed base operators, fuel

providers, regulators, legal advisors, leasing

companies, banks, investors and private jet

users.